- MN ABE Connect

- Archive

- Bringing Financial Literacy into the ABE Classroom

January 13, 2023

January 13, 2023

Bringing Financial Literacy into the ABE Classroom

Helen Delfeld, Financial CoachWhy Teach Financial Literacy as a Core Component of ABE?

Financial literacy is too often overlooked. People of all stripes may have a level of financial literacy that hinders their ability to function day to day, much less build life plans or get ahead. Our primary constituency here at the International Institute of Minnesota ─ new Minnesotans who were born outside the country ─ are especially vulnerable.

Let’s take the most basic financial service: banking. While only 2.1% of white households in the U.S. do not have bank accounts, 9.3% of Hispanic households and 11.3% of Black households are “unbanked,” meaning they have no checking or savings account. Imagine how difficult that would be. No writing checks, no credit card purchases, no automated payments, no security for your savings.

And with no ability to invest saved money to stay ahead of inflation, you’re better off spending it. You can’t build a credit score, so any loans for say, a car, are often at predatory rates. You lack documents and collateral needed to access opportunities like a better apartment, or even sometimes, a driver’s license. You pay a fee to cash your paycheck, while that same check cashing service encourages taking cash “advances” at extortionate interest rates. Such unequal burdens are, predictably, likeliest to fall on those least able to absorb them.

This is where financial literacy comes in, not only in opening an account, but doing it wisely — even people who have bank accounts, not just unbanked folks. For example, people could learn how to comparison shop between banks to avoid undue fees by finding a no-fee checking account. Hidden bank fees can cause a financial cascade, which can result in an account being punitively closed, making it difficult to open another one elsewhere.

This is where financial literacy comes in, not only in opening an account, but doing it wisely — even people who have bank accounts, not just unbanked folks. For example, people could learn how to comparison shop between banks to avoid undue fees by finding a no-fee checking account. Hidden bank fees can cause a financial cascade, which can result in an account being punitively closed, making it difficult to open another one elsewhere.

Teaching financial principles alongside other ABE goals is both useful and effective.

People want this knowledge. They just don’t know where to start. Financial institutions typically aim themselves at those with substantial assets, while financial education often circulates in a gray market of rumor and fear.

Where to Begin?

There are ways to turn these obstacles into lesson plans. Building knowledge of relevant terms and applying them in a language level appropriate to the classroom will help build a durable knowledge base to help enable solid financial choices.

Next Gen Personal Finance (https://www.ngpf.org/) is a terrific site with many useful tools. They have a banking simulator in which you and your students walk through setting up an online bank account, perform some sample transactions, and learn vocabulary that all banks use.

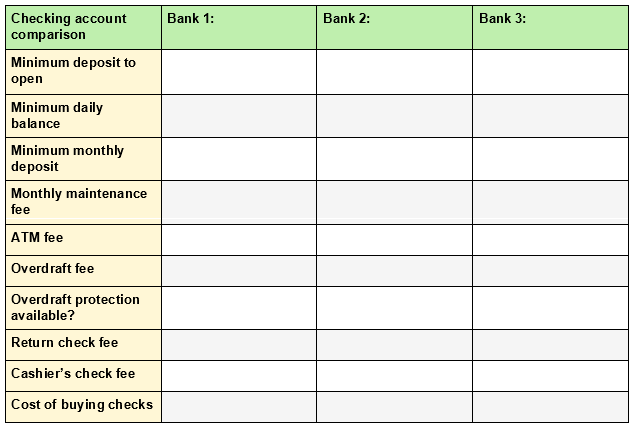

You can also print out a simple grid like the one below for students to source and research banks, with vocabulary words on the left and additional columns to fill in data. Filling in the fee schedules for several banks will allow for repetition of vocabulary, and let them apply their new knowledge while comparing and contrasting different fee structures.

Try conducting this as a group exercise first, learning to navigate different bank websites and applying their new vocabulary, all while developing digital and financial literacy. Alternately, a teacher could eliminate the search component and instead provide three different banks’ fee structures in handouts.

Some useful questions to guide students after the initial information gathering:

- Do you need a minimum balance at every bank?

- Is a basic checking and savings account free automatically?

- Is there a way to get free checking and savings accounts through this bank?

- Do you get advantages for direct deposit?

- How much do you pay if you pay a bill that is bigger than your balance?

- Can you get overdraft protection? How does that work, and what does it cost?

Real World Applications + Real World Results = Real Engagement

I try to assure each class has at least one actionable takeaway per class session. Useful takeaways could include:

- Discussing FDIC insurance to help people understand their deposits are safer in the bank than in the closet.

- Discussing overdraft protection, increasingly available at different banks as an option — but one people have to sign up for.

- Discussing the difference between savings and checking accounts, as a preliminary discussion to the value of saving money, especially an emergency fund.

- Discussing the importance of having an emergency fund, even on a small income.

Financial literacy basics are easy to teach, and very rewarding to learn. Starting from the position of the unbanked is a great way to start building that knowledge base from the beginning.

Newsletter Signup

Get MN ABE Connect—the official source for ABE events, activities, and resources!

Sign UpArticle Categories

- ABE Foundations/Staff Onboarding

- ACES/Transitions

- Adult Career Pathways

- Assessment

- CCR Standards

- Citizenship

- COVID-19

- Cultural Competency

- Digital Literacy/Northstar

- Disabilities

- Distance Learning/Education

- ELA

- Equity/Inclusion

- ESL

- HSE/Adult Diploma

- Listening

- Math/Numeracy

- Mental Health

- Minnesota ABE

- One-Room Schoolhouse/Multilevel

- Professional Development

- Program Management

- Reading

- Remote Instruction

- Science

- Social Studies

- Speaking/Conversation

- Support Services

- Teaching Strategies

- Technology

- Uncategorized

- Volunteers/Tutors

- Writing