- MN ABE Connect

- Archive

- Developing College Knowledge

June 4, 2019

June 4, 2019

Developing College Knowledge

Stephanie Sommers, ACES CoordinatorFor the past year or so, I have been thinking a lot about the role that navigators play in helping ABE students find success. Although navigators can fill many roles, they are often thought of as advisors or counselors. Among other things, they help students to identify and reach their goals; to access support services; and to plan a course of study. Although the exact services that navigators provide might vary, the goal is to help students develop “true readiness” so that they are able to achieve college and career success.

The National College Transition Network (NCTN) identifies four components to “true readiness”: personal, career, academic, and college. When I look at how each of these areas is defined and the competencies that one would need to have to be “ready” in each area, I see a clear connection with ACES/TIF, one of our three sets of MN ABE Content Standards.

Just as there is some overlap between the skills in the different categories of the TIF, there is also some overlap in how the areas of readiness connect with the TIF. I see these four categories as having the most direct connections:

- Self-Management & Personal Readiness

- Developing a Future Pathway & Career Readiness

- Learning Strategies & Academic Readiness

- Navigating Systems & College Readiness

Given the strong connection between “true readiness” and ACES/TIF, it was natural to start thinking about how the framework could be used to develop these important skills with adult learners. In fact, I started to wonder if ABE teachers could provide some navigation support to learners by embedding more ACES/TIF skills in their classrooms.

This thinking has led to the development of a webinar, a regional session, and a PLC that all explore how ACES/TIF can be used to develop navigation practices with ABE teachers. It’s been an exciting subject to explore, and I’ve enjoyed hearing about how different ABE programs are trying to provide navigation services. Many programs have developed a process for orienting new students and helping them to identify personal and professional goals. Programs also have ways of tracking students as they move through the various classes and levels, and even as they stop out of classes altogether.

What seems to be most challenging is supporting students as they transition out of ABE and into college, work, or training programs. Keeping this in mind, I started searching for resources that are specifically related to helping students as they get ready to leave our classrooms. I found a useful toolkit that was developed by the Consumer Financial Protection Bureau that helps students to think about paying for college. It has a variety of tools for comparing how much it will cost to go to school at different colleges, and how much debt a student will have at graduation. The Paying for College tools (https://www.consumerfinance.gov/paying-for-college/) have been added to the Navigating Systems category of the ACES Resource Library.

Unlike many of the other resources in the ACES Resource Library, Paying for College doesn’t have worksheets, lesson plans, or other downloadable materials. It is not a curriculum. I think of it more like the websites that we often have students use to do career exploration, such as O*Net or the Occupational Outlook Handbook. It is a government database that provides information about how to apply for funds to pay for school and how to use those funds wisely.

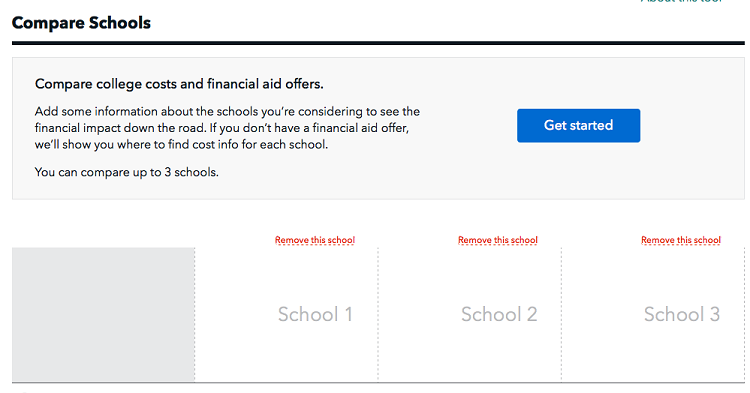

Students can dig into the differences between federal and private student loans, for example, and there is also a link to fill out a FAFSA. Another tool allows students to compare up to three schools so that they can get an idea of how much they will spend on their degree and how much debt they will have at graduation. The tool helps students to think about all of the costs of attending school – housing, books, food, transportation – and not just the cost of tuition. Once all of the information is entered, students get a comprehensive picture of costs, debt, and what monthly loan payments will look like after they graduate.

One thing that I like about Paying for College is that it provides links to other useful resources for students, such as the College Scorecard website, which is maintained by the U.S. Department of Education. This website allows users to search by program/degree, area of the country, size of the institution, and apply other filters in order to find schools that offer programs aligned with their interests. When the search results are displayed, you can easily compare schools by looking at average annual costs, graduation rates, and salary after attending. In this way, Paying for College becomes a great resource for anyone who wants to explore college, but isn’t sure where to start.

We all know, either through personal experience or by listening to frequent reporting on the topic, that student loan debt is a major problem in our country. If we want to help our students develop college readiness, we should be making them aware of resources that can help them to make sound decisions about college, and providing them with opportunities to explore those resources.

Newsletter Signup

Get MN ABE Connect—the official source for ABE events, activities, and resources!

Sign UpArticle Categories

- ABE Foundations/Staff Onboarding

- ACES/Transitions

- Adult Career Pathways

- Assessment

- CCR Standards

- Citizenship

- COVID-19

- Cultural Competency

- Digital Literacy/Northstar

- Disabilities

- Distance Learning/Education

- ELA

- Equity/Inclusion

- ESL

- HSE/Adult Diploma

- Listening

- Math/Numeracy

- Mental Health

- Minnesota ABE

- One-Room Schoolhouse/Multilevel

- Professional Development

- Program Management

- Reading

- Remote Instruction

- Science

- Social Studies

- Speaking/Conversation

- Support Services

- Teaching Strategies

- Technology

- Uncategorized

- Volunteers/Tutors

- Writing